TL;DR: Why Cambodia Is the Most Overlooked Real Estate Opportunity in Asia

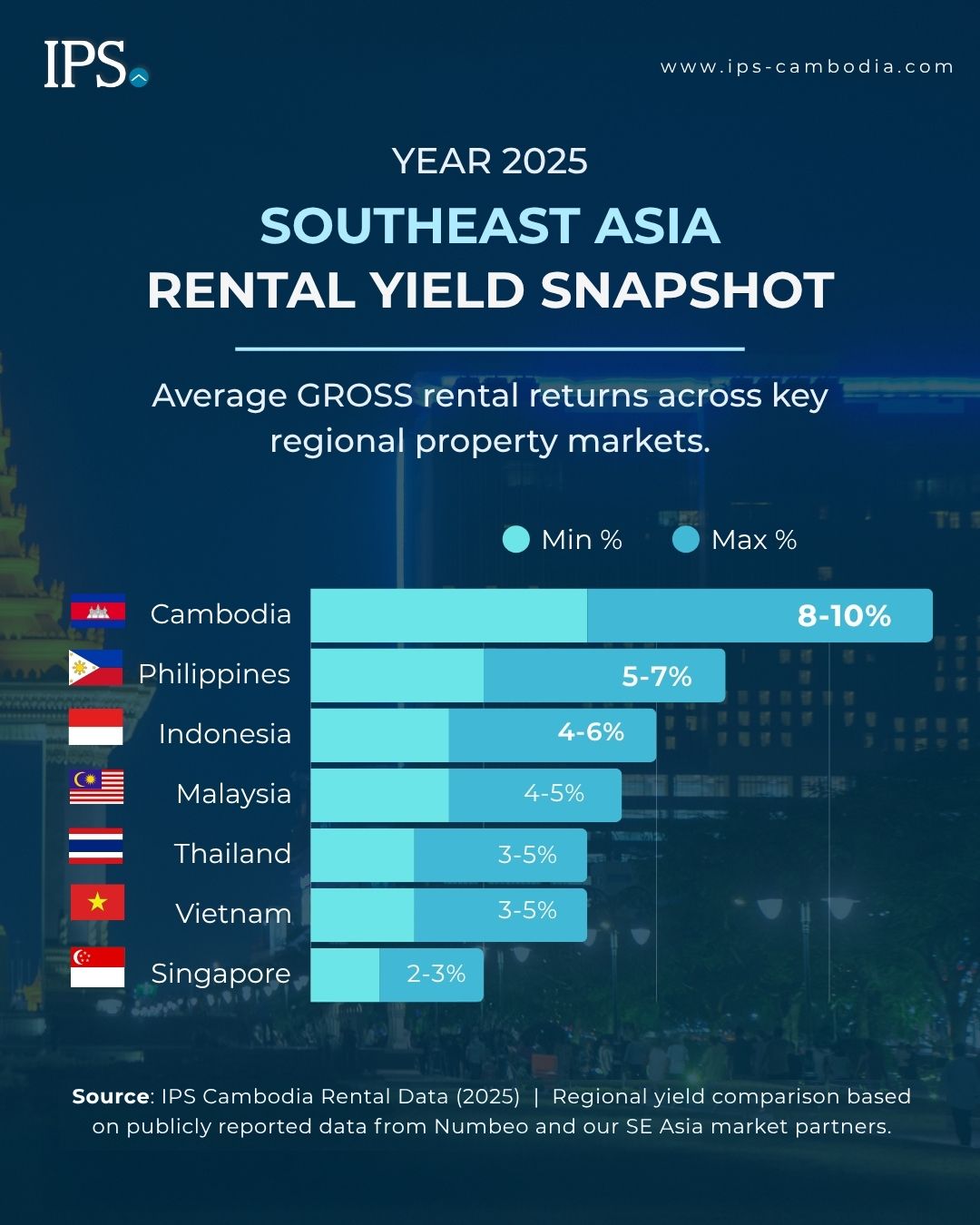

- Strong fundamentals: USD economy, 100% foreign ownership, and rental yields averaging 6–8% net (8-10% gross).

- Sustained growth: Infrastructure expansion, rising incomes, and improving developer quality continue to build investor confidence.

- Accessible opportunity: Entry prices remain lower than Thailand or Vietnam, yet market fundamentals are similar.

- Hands-off investing: IPS Cambodia provides full legal, management, and resale support for international buyers.

- Exclusive advantage: IPS clients enjoy 8% property management fees, compared to the market’s usual 10%.

Should you invest in Cambodia Real Estate?

If you’ve been priced out of Bangkok or Vietnam, the answer is a resounding YES! Few markets in Asia check every box for stability, yield, and accessibility and Cambodia is one of them. With a dollarized economy, transparent ownership laws, and rental yields that outperform the region, it offers investors a rare balance of protection and performance.

Cambodia: A Market Hiding in Plain Sight

Cambodia is quietly becoming one of Asia’s most promising property markets, yet few investors have noticed. While capital continues to pour into Bangkok, Ho Chi Minh, and Bali, Cambodia offers an untapped blend of affordability, accessibility, and growth potential. With a fully dollarized economy, 100% foreign ownership for strata-titled properties, and steady rental yields averaging 8-10%, the country has the same fundamentals that once defined the region’s fastest-growing real estate stories. Despite its strong GDP growth, rapid urbanization, and increasing investor confidence, Cambodia remains largely overlooked. It combines stability with early-stage opportunity; a rare mix that international investors usually find only once in a generation.

What’s Driving Cambodia’s Real Estate Growth

What makes Cambodia so compelling for international investors is not hype but structure. Few emerging markets combine this level of openness with stability.

A US-Dollar Economy

Cambodia operates on a dual-currency system dominated by the US dollar, which accounts for most property transactions, business dealings, and bank deposits. This structure gives investors built-in protection against exchange-rate volatility and simplifies international fund transfers.

For foreign buyers, a dollarized economy also means rental income, property prices, and resale proceeds are all denominated in USD, reducing currency risk and ensuring financial transparency. It is one of the key reasons global investors view Cambodia as a stable entry point into Southeast Asia’s real estate market.

Read: Why Are Global Investors Attracted to the Cambodian Real Estate Market

Secure Foreign Ownership

Foreigners can legally own 100% of strata-titled properties in Cambodia, including condominiums and commercial office units. The process is straightforward and protected by the 2009 Foreign Ownership Law, which allows freehold titles above the ground floor of any registered development.

Unlike in many neighboring markets where foreign ownership is restricted or leasehold-based, Cambodia provides true freehold ownership with low transfer taxes and clear title registration. This transparency and legal security make it one of the most accessible property markets in Southeast Asia for international buyers.

For a broader overview of Cambodia’s property market landscape, read Investing in Cambodia Real Estate.

High Yields and Fast Appreciation

Based on IPS rental data across Phnom Penh, average net returns range from 6% to 8% (8-10% gross), driven by strong tenant demand and a growing expat community. Property values in key districts such as Tonle Bassac, BKK1, Toul Kork, and Toul Tom Poung continue to rise as new developments reshape the skyline. While yields in Bangkok and Ho Chi Minh average around 3–5% (gross), Phnom Penh continues to offer nearly double that at lower entry prices.

Many IPS clients who purchased Phnom Penh condos five years ago are now enjoying steady rental income and resale values 20–30% higher than their initial launch prices, proving that well-selected properties in this market can deliver both short-term returns and long-term growth.

Read: Phnom Penh Condo Market Trends

A Young, Growing Population

With more than 18 million people and a median age of just 25, Cambodia has one of the youngest populations in Southeast Asia. This demographic is becoming increasingly educated, urban, and digitally connected, driving demand for housing, retail, and modern lifestyle spaces.

According to World Bank data, Cambodia’s labor force participation rate is among the highest in the region, with around 80–85% of adults active in the workforce. This strong labor base underpins steady economic growth and supports the country’s long-term urban development.

For investors, these trends translate into sustained rental demand across Phnom Penh and other growing cities. As incomes rise and younger generations transition from renting to owning, the market is set to experience healthy capital appreciation across both condominium and landed housing sectors.

Consistent Growth and Rising Incomes

Cambodia has sustained one of Southeast Asia’s most stable growth rates, averaging around 7% GDP expansion over the past decade, with the World Bank projecting continued growth near 6% annually. This steady performance, supported by a US-dollar economy and resilient private sector, is driving household income gains and rising domestic consumption.

As more Cambodians move into the middle-income bracket, demand for modern housing, retail spaces, and investment-grade properties continues to grow. The nation is projected to reach upper-middle-income status by 2030, a milestone that typically marks rapid urban development and long-term property appreciation in emerging markets.

Read: From Smart Factories to Mega Projects: Cambodia’s Growth in Numbers

Cambodia Property Market 2025: Infrastructure, Confidence, and Growth

Momentum is building not just in property prices, but in infrastructure, confidence, and quality. Major projects like the Techo International Airport will connect Phnom Penh directly to more global destinations and relieve congestion at the existing airport. The Phnom Penh–Sihanoukville Expressway and ongoing port expansions in Kampot are reshaping logistics and trade routes across the country. At the same time, Cambodia’s tourism revival continues to strengthen property demand in Siem Reap and coastal destinations, while developers are raising the bar with LEED-certified designs, improved build quality, and transparent sales practices.

Investors are increasingly seeing Cambodia as where Thailand and Vietnam were a decade ago: markets that surged after years of being underestimated. The difference is that Cambodia offers the added security of a USD-based economy and lower entry prices.

Understanding the Risk and the Reward

Like any fast-growing market, Cambodia has its challenges. Some investors worry about overbuilding, project delays, or varying developer quality. However, Cambodia’s transparent foreign ownership laws, combined with IPS due diligence and developer screening process, give investors a layer of protection many emerging markets lack. Read: Common Hazards for Cambodia Condo Investors IPS works only with verified, financially stable developers and ensures every transaction complies with local regulations, giving foreign buyers peace of mind that their investments are secure and well-managed.

Navigating the Market #IPSDifference

For international investors, opportunity alone is not enough. Success depends on having the right partner. That is where IPS Cambodia comes in. With decades of experience and offices in Phnom Penh and Siem Reap, with trusted partners in other parts of the country, IPS has built its reputation as the country’s most trusted real estate agency for foreign buyers. From consultation to long-term management, IPS provides a fully managed, hands-off investment experience:

- Trusted developer partnerships with top-performing residential and commercial projects

- Comprehensive legal and tax compliance services

- Full lease acquisition and tenant management

- Monthly financial reporting and USD rent transfers

- Maintenance oversight with transparent costs

- End-to-end resale support to maximize exit returns

IPS’s resale network helps international owners sell to both local and overseas investors, ensuring healthy liquidity even in a developing market.

And for investors purchasing condos through IPS specifically for rental income, the experience goes even further. IPS’s dedicated Property Management team handles everything from marketing and tenant screening to rent collection and maintenance, ensuring consistent returns with zero stress. Typically, property management services are set at 10% of monthly rent, but clients who purchased their properties through IPS enjoy a preferred rate of 8%, making long-term investment even more rewarding.

For many investors, IPS serves as a long-term partner, providing the structure and oversight that keep their Cambodian portfolios performing predictably and professionally.

IPS Recommended Projects for Investors

IPS partners only with developers who meet international standards of quality, transparency, and performance. Below are some of the most promising projects currently available, selected for their location, developer reputation, and strong rental or resale potential.

Phnom Penh’s Landmark Vertical Community

Located on Norodom Boulevard in the capital’s central business district, ODOM is redefining Phnom Penh’s skyline through its mixed-use concept of residences, offices, and retail anchored by a Vignette Collection hotel. Developed by Urban Living Solutions (ULS), ODOM is built for long-term sustainability, featuring LEED-oriented design and high construction standards.

-

Guaranteed Rental Return (GRR) program on ODOM Tower commercial offices, providing predictable income and up to 50% returns!

-

Premium CBD address on Norodom Boulevard, with high tenant demand.

-

Managed by IPS with full investor support for leasing, reporting, and resale.

Ideal for investors seeking CBD-grade assets with stable rental income and strong capital appreciation potential.

Cambodia’s Tallest Residential Tower

Developed by Tanichu Group, J Tower 3 is set to become Cambodia’s tallest residential building, combining Japanese precision, earthquake-resistant engineering, and skyline views in the heart of Tonle Bassac.

-

Projected rental returns up to 9%, based on performance of J Tower 2, which has achieved returns of 10–12% for IPS-managed units.

-

Freehold ownership with flexible payment plans up to 2028.

-

Premium design and proven developer reputation among Japanese and international buyers.

An excellent choice for investors seeking high-yield, high-quality assets in Phnom Penh’s most dynamic district.

Timesquare 7 Phnom Penh

Located in Boeung Kak 1, Toul Kork, Time Square 7 showcases contemporary design and urban comfort. Ideal for city living, it offers a blend of convenience and quality in one of Phnom Penh’s most connected areas.

Timesquare 8 Phnom Penh

Located in Boeung Trabek near the Russian Market, Time Square 8 showcases modern elegance and functionality. Ideal for investors, it offers a perfect blend of style and convenience in Phnom Penh’s vibrant real estate market.

Timesquare 10 Otres Beach

Newest beachfront landmark combining affordable ownership with resort-style living, offering one of Sihanoukville’s most attractive entry points into Cambodia’s coastal property market.

TUI BLUE Angkor Grace, Siem Reap

Set in the picturesque city of Siem Reap, close to the iconic Angkor Wat, this development is more than a living space—it’s a sanctuary for wellness. Ideal for both travelers and expatriates looking for a serene retreat.

Rose Apple Square Siem Reap

Poised in the lively heart of Siem Reap, Rose Apple Square combines luxury and affordability. Get up to 11.4% return per year and a 5-year guaranteed buyback. A perfect investment gateway into the emerging Cambodian real estate market.

All projects are backed by IPS’s full support from purchase to property management, ensuring investors can enter Cambodia’s market with confidence and convenience.

Outlook: The Next Tiger Economy

Cambodia’s transformation is accelerating. Foreign confidence is rising, infrastructure is expanding, and world-class developments are reshaping cities across the country. The next wave of growth belongs to those who recognize the advantage of entering a market before it becomes mainstream.

With the right partner, that opportunity becomes tangible. IPS Cambodia stands ready to guide international buyers through a smooth, transparent, and rewarding investment journey in what may soon be Asia’s next tiger economy.

Contact our investment team for a free consultation on the best projects and entry options for your budget.

→ Talk to an IPS Advisor

→ Request Investment Guide

→ Explore New Developments in Cambodia

• Introduction to Cambodia

» Introduction to Phnom Penh

» Introduction to Siem Reap

» Monarchy & Government

• Tourism & Residency

» Thriving Tourism Industry

» Visas in Cambodia

• Healthcare & Education

» Healthcare in Cambodia

» Education in Cambodia

» International Schools in Cambodia

• Technology

» The Rise of Technology in Cambodia

• Why invest in property in Cambodia?

• Why Invest in Condominiums?

» Condo Ownership Journey in Cambodia

• Why Phnom Penh is SEA’s New Real Estate Hotspot

• Cambodian Property Tax Guide

» Navigating Rental Property Taxes in Cambodia

• Can Foreigners Own Land in Cambodia?

• Understanding Cambodian Property Titles

» Strata Title: Background, Benefits, Legal Value

• Understanding Perpetual Leases in Cambodia

• The IPS Cambodia Advantage

» Why Choose IPS?